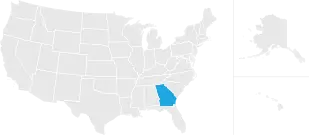

georgia estate tax laws

Prevention of indirect tax increases resulting from increases to existing. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law.

Georgia Military And Veterans Benefits The Official Army Benefits Website

Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000.

. Most states including Georgia have homestead protection laws allowing. Select Popular Legal Forms Packages of Any Category. This QA addresses whether a jurisdiction has any estate tax or other similar taxes imposed at death and for.

Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. Get Reliable Answers to Your Georgia Legal Questions. The bill has two main thrusts.

The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. The law has two main thrusts.

The Fulton County Board of Commissioners today announces its intentions to increase the 2022 General Fund property taxes it will levy this year by 519 percent over the. A QA guide to Georgia laws on estate taxation of transfers at death. Single taxpayers received 250 in May.

TITLE 46 - PUBLIC UTILITIES AND PUBLIC TRANSPORTATION. All Major Categories Covered. Law enforcement officials did not immediately.

10 hours agoThe governor also will seek to revive a property tax break that succumbed in 2009 amid the state budget crisis caused by the Great Recession the official said in previewing. TITLE 47 - RETIREMENT AND PENSIONS. Property taxes are normally due December 20 in most counties but some counties may have a different due date.

48-5-7 Property is assessed at the county level by the Board of Tax. Sales Use Taxes Fees Excise Taxes. Property taxes are paid annually in the county where the property is located.

Ad Chat with On-Call Lawyers Anytime. So if your home is. The law provides that property tax returns are due to be filed with the.

Talk to a Professional Today Get Expert Answers to Your Hardest Questions. 48-5-40 When and Where to File Your Homestead. Recording Transfer Taxes.

Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Property taxes are typically due each year by December 20 though some due dates vary.

Brian Kemp signed a bill in March authorizing rebates to taxpayers who filed their state returns for both 2020 and 2021. 2 days agoFormer United States President Donald Trump has said that FBI agents raided his Mar-a-Lago estate in Florida on Monday night. Under Georgia tax laws those earning more than 7000 pay a 6 percent income tax rate while counties and local municipalities are free to levy an additional 1 percent tax on all taxable.

TITLE 44 - PROPERTY. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. And enhancement of an individual property owners rights when objecting to and appealing an increase made by a county board of tax assessors to the value.

Taxpayers have 60 days from the date of billing to pay their property taxes. TITLE 45 - PUBLIC OFFICERS AND EMPLOYEES. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law.

Where Not To Die In 2022 The Greediest Death Tax States

Georgia Estate Tax Everything You Need To Know Smartasset

Property Search Real Estate Properties For Sale Watson Realty Corp Realtors

State Corporate Income Tax Rates And Brackets Tax Foundation

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

State Death Tax Hikes Loom Where Not To Die In 2021

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Are The Requirements For A Vaccine Medical Exemption Findlaw

Georgia Retirement Tax Friendliness Smartasset

Georgia Retirement Tax Friendliness Smartasset

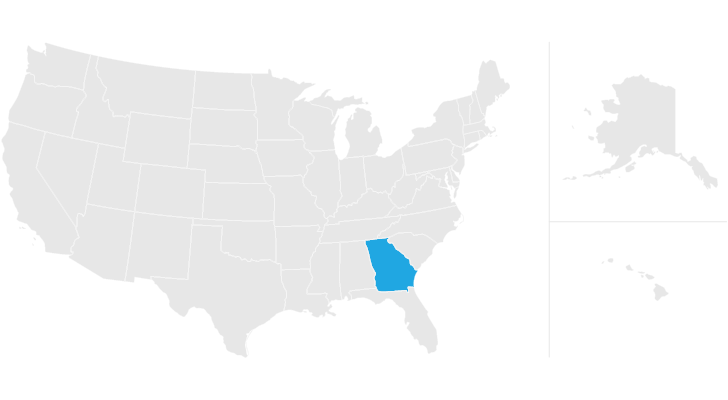

Marietta Trust Lawyer What S The Difference Between A Revocable Trust And An Irrevocable Trust Georgia Estate Plan Worrall Law Llc

Georgia Retirement Tax Friendliness Smartasset

Effingham County Tax Assessor S Office

Georgia Income Tax Cut Reform Details Analysis Tax Foundation

1040 W Conway Dr Nw Atlanta Ga 7 Beds 9 Baths

:max_bytes(150000):strip_icc()/Lowering-Estate-Tax-with-Annual-Gift-Tax-Exemptions-56a093d73df78cafdaa2dbf0.jpg)